What we do

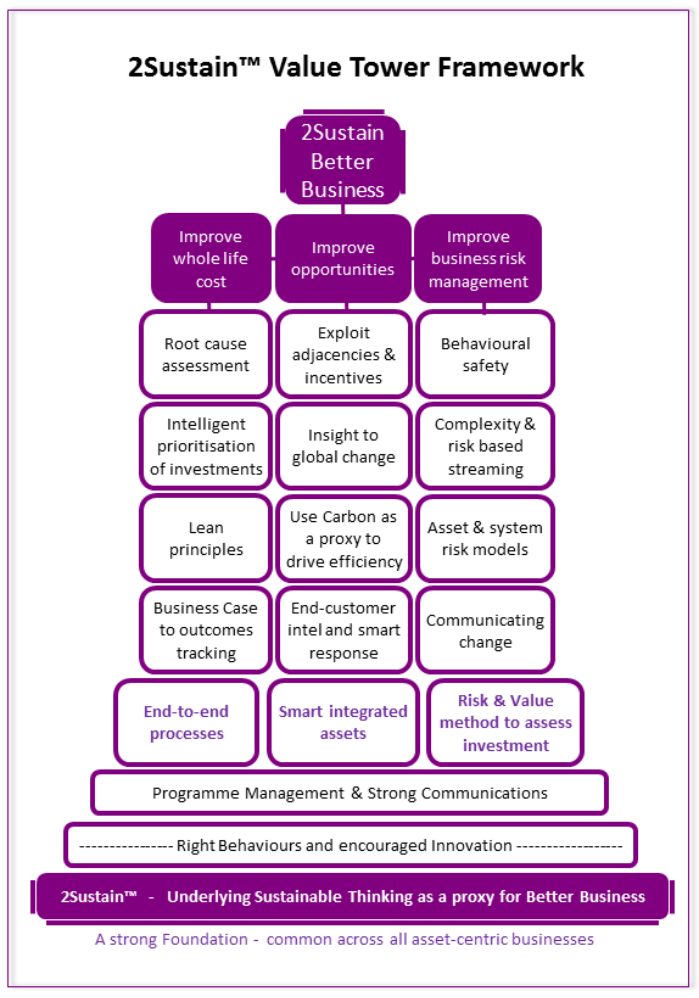

The 2Sustain™ Value Tower comprises the seventeen most important areas for a business to drive value, be that value to the shareholders, stakeholders, customers, regulators and/or employees. Each area is associated with either driving down the cost of service (bottom line), taking advantages & opportunities (top line), and/or managing the business risk. Business risk is often reputational due to failure of assets and subsequent customer impact or plain and simple lagging behind competitors & innovators and the resultant business impact that can create.

Value drivers:

Root cause assessment: so often a business case or project is launched, yet the true root cause of the issue driving the project is not fully understood and hence the effect is treated as opposed to the root cause being solved. Multiple effect treatments can swell below the surface and sudden expose the business to undue risk; also avoidance of addressing the root cause often leads to increased whole life cost and operational fixes, which in themselves breed more issues. So a RCA workshop and methodology gets to the right way forward.

Intelligent prioritisation of asset investments: There are so many ways to prioritise asset investments, projects, and tasks. Often the priority is set by one department/team; by whomever shouts loudest; is overtaken by the need for reactive fire-fighting; a black box asset model, or simply does not get properly prioritised. But what is required is an approach that considers the right balance and smart way of managing whole life cost, taking opportunity and managing business risk.

Lean principles: Once one knows that the right project/issue is being addressed and is prioritised in the right order, then seeking to understand where there is waste in the delivery process is crucial. Even the best performing businesses still have over 50% waste in their processes. Having one data-centric view on everything is important (one version of the truth), without this high levels of process waste occur within businesses.

Business case outcome tracking: So many businesses select their projects and tasks, based on a complex decision process, considering the needs and the drivers. Once decided though the project is handed over to the delivery process owner and often disconnected from its original objectives and drivers. This is a fundamental failing. It is essential to track the project to see it is on course and eventually does 'do what it says on the box' because without this there can be not benefits realisation verification, outcome validation, lessons learnt, knowledge improvement nor continuous improvement of performance.

End to end processes: All of the above is then wrapped into a simple to use and easy to visualise end-to-end process. Having an end to end process is not rocket science, yet is rarely done. The two 'ends' are: (start>) need, objective, rational, outcome desired and (finish>) impact and resultant outcome to the business, stakeholders and end customer/user. It is not just the perspective of the internal processes.

Exploiting adjacencies & incentives: This involves looking wider than the immediate core business. Although focusing on core business is very important. Seeing how end customers are being impacted by the service and what their changing needs are.

Opportunities are all around but come with risks, in fact the risk & opportunity (R&O) equations are very closely linked.

Governments also seek to engineer/drive change, often doing this with incentives mechanisms. Take for example: Renewable obligation commitment, renewable feed-in tariff, renewable heat incentive, ETI grants, TSB grants, European Union infrastructure funds and structural funds.

Insight to global change: Insight is a wonderful thing. Hindsight is the punishment. Clearly futurology is very challenging, but change is happening and happening fast in many sectors/categories. Asset centric businesses have to look to the future and ensure their current asset base is scalable, adaptable and compatible for future change. Stranded assets and rapid depletion of asset value can be significant risks. Key examples of hot topic changes that have to be accommodated are: climate change, climate change mitigation policy changes, adaptation to climate change, energy and resource scarcity, the internet of things, the rapid advancement of communications capability and comms everywhere, an ageing population, a global population growing to 10billion+ (peak human), and enhanced customer expectations (they want their underlying utility services to be provided just like an order to Amazon).

Using carbon as a proxy to drive efficiency: Carbon started off as an eco-domain and then a business CSR issue and then a need to do mandatory carbon reporting. But carbon can be used for so much more. By understand the carbon impact of business units, sites/plants, project option decisions, and alike, one can benchmark the carbon performance. Carbon is an excellent proxy for inefficiency and waste. Therefore by driving down total carbon one is potentially driving out waste and driving up resource efficiency. Carbon as a proxy also gives clues about the wider environmental impact of decision or investment; it can also be easily monetised for including in whole life cost calculations.

Of course carbon is just one multi parameters in business decision making, but can be a key enabler to drive innovation and make better decisions for the long term sustainable business.

Thinking innovatively around driving down carbon creates more empowerment for the team than simply cutting cost. Yet the result is often the same. It really does work!

End-customer intelligence and smart response: Closely linked with insight to change, understanding customer perception is crucial. For example: are most customers prepared to pay just a little more for their water (and perhaps subsidise social poverty) in return for a better service where risks of scarcity, loss of supply and flood are reduced?

Also, with social media, the power of the customer has got stronger and is growing, hence a greater need to understand the asset failure risks and how they impact customers (and their perceptions) is becoming crucial.

SMART INTEGRATED ASSETS: Much of the above drives the need to have smart utilities and smart assets. Where each component building block of the business solution is used to its utmost, and data/information and knowledge about that assets are used to its utmost, and hence the assets are sweated to their utmost.

Most asset owners now have a vast bank of data (both static asset data and real-time information) but using it to improve business performance and enhance the customer experience is a grand challenge. 'Turning data into opportunity and action' is both the challenge and opportunity.

Yet the rapidly growing 'Internet of things' revolution is happening right now and making so much more compatible and connectable information about assets 'things' available at a tenth of the cost of the past. The challenge is to take advantage of this cheap data.

Behavioural safety: Safety incidents can have such a large business impact, beyond even the obvious personnel H&S issues, they can impact business reputation, customer perception, and most significantly they are a proxy for waste, poor processes and excess cost. One safety incident has so much hidden cost.

Just like the saying 'a tidy site is a safe site', so then 'a behaviourally safe business is a better business'.

Getting this right has so many knock-on benefits to the business as a whole.

Complexity & risk based streaming: As with everything in life, one size does not fit all. Different parts of a business undertaking need to have streams or runways. Some simple and low business risk projects are 'just do' and there is no point is applying complex assessment to their merits or how it affects business risk. However, at the other extreme are complex projects that have business impact merit or disadvantage- these need to be analysed in some detail. The traditional Value/Time/Cost curve shows that doing this early-on will add the most value. So the end to end processes need to have different streams, particularly around the business case definition and optioneering phases. A simple categorisation method can be applied to decide which undertaking takes which stream.

Asset & system risk models: Understanding how assets behave and whether they are operating outside their normal envelope is becoming an important feature of smart companies. These techniques are already applied in the manufacturing and logistics industries, but are being rolled out rapidly to nearly all walks of life.

Historically in the utilities sectors, it has often been the customers telling the company that they have a problem and not the other way around. This is changing. Take the example of a pumping station that pumps away sewage, it can be monitored in so many ways, to the extent that it's likely time to failure, drop-off in efficiency, run-time profile can all be analysed to conclude how likely the asset is going to contribute to the company’s business risk so that proactive (as opposed to reactive) intervention can take place.

Imagine the value of a management dashboard that lists the top 50 risky assets (in real-time) to your business with an estimate of days to failure- that can really focus the O&M team, and maybe customers can be warned in advance in order to get their buy-in to any local disruption during pre-emptive maintenance work; and hence minimise any risk of customer complaints.

Communicating change: Change is always happening, in some form or another. Businesses have to respond to external change in addition to any in-house business change they may implement. It is often the communications of change that lags compared to technical and management aspects of the change taking place. Change is a complex 'people centric' process and should not be under-estimated. Get it wrong and the business can be badly impacted. Get it right and the business can be propelled to best-in-class and spiral upwards.

RISK & VALUE METHODS TO ASSESS INVESTMENTS: A good way to evaluate the impact of business risk and make better long term decisions, that assimilates much stated above, is to use a 'Risk and Value' evaluation approach. Whereby, the 'as is' (do nothing) business risk relating to a business case, asset or business issue is assessed. Its mix of likelihoods and severity of events being quickly assessed and visualised and monetised (often using a simple lookup where almost anything can be evaluated quickly).

The 'to be' (future options) can then be evaluated on the same basis and all visualised together in a workshop environment to build change buy-in. Collectively the joint decision can be generated based on the business risk improvement value with respect the whole life investment cost to achieve this. Equally this technique can be used for assessing opportunities (the opposite of business risk) and business adjacencies. The technique can also be used to validate that business risk is not reduced to very low values- because undoubtedly that would not be good value for money.

Right behaviours and encouraged innovation: Doing all these value creating activities doesn't come easily; it requires teams of people with common alignment, the right values, and right behaviours to drive this forward. It takes time, effort and team training; but a progressive programme to sustain a better business can be created. The whole process needs to be managed as a strategic change programme, which in turn needs advocates to buy-in to the need, reason and end objective. It then becomes a self-fulfilling business improvement exercise that inherently encourages innovative thinking and actions.

Sustainable thinking as a proxy for better business: You may not have realised it, but virtually everything above is about sustainability (economic, environmental and social) and about making the business more sustainable. It's not rocket science and much is purely common sense. By building sustainable thinking as the foundation into the value creating journey, a business is most likely to lead to: lower unit costs, improved opportunities, reduced business risk, better end-customer perception, improved competitively, more opportunities and overall to sustain a better business.

FRAMEWORK: this is a common framework, with a foundation that is backed by methods, tools, experience, and successes, that can be applied to any asset-centric business that needs/wants to sustain a better business.